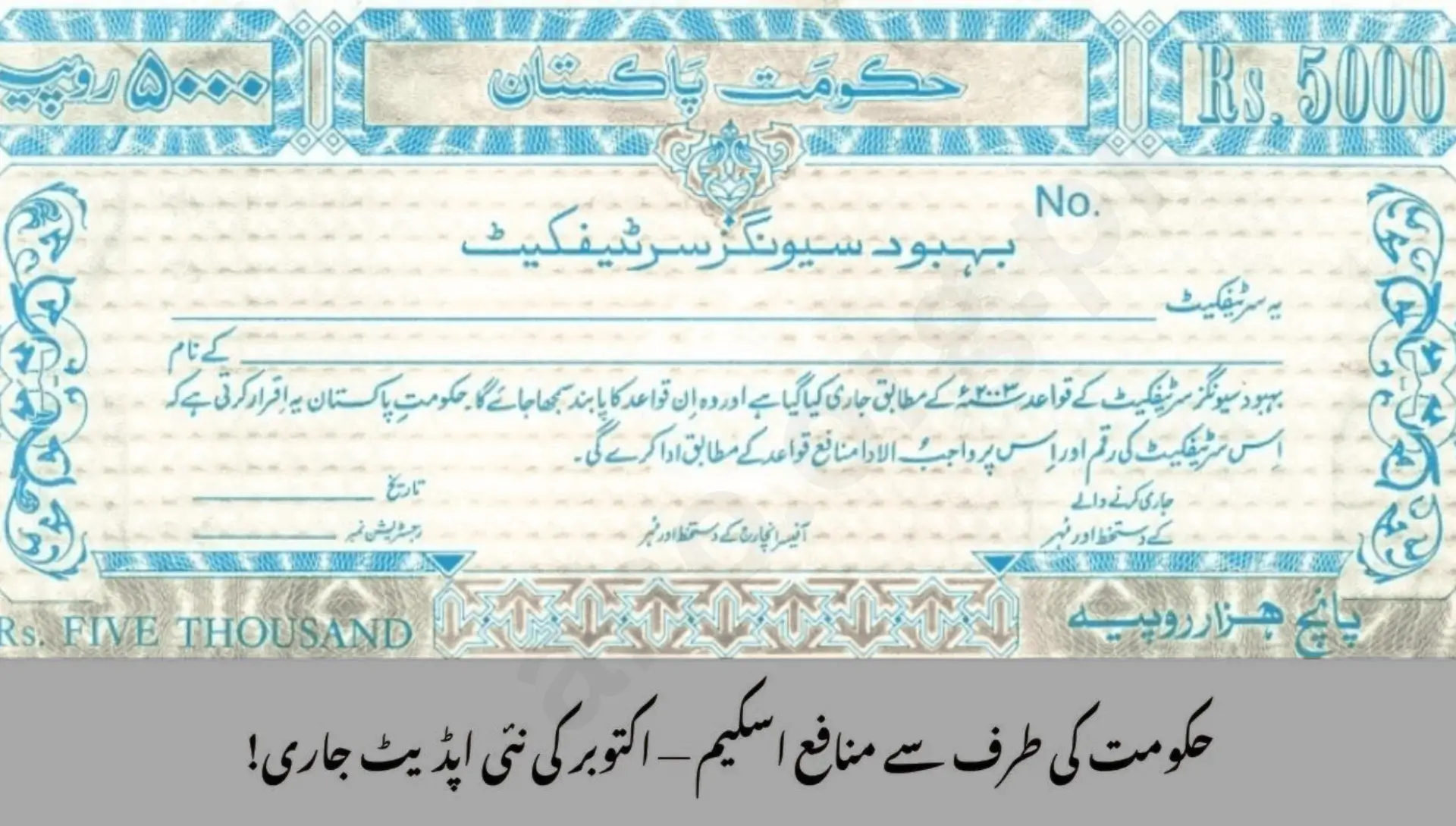

Behbood Savings Certificates (October 2025 Update): Earn Big with Up to 50 Lac Investment Limit

Behbood Savings Certificates (October 2025 Update): Earn Big with Up to 50 Lac Investment Limit. If you’re searching for a secure and high-return investment in Pakistan, Behbood Savings Certificates (BSCs) might be your best choice. Managed by the Central Directorate of National Savings (CDNS), this government-backed scheme offers attractive monthly profits and guaranteed safety.

As of the October 2025 update, the Behbood Savings Certificates profit rate has increased to 13.68% per annum, making it one of the most rewarding investment options for senior citizens, widows, and persons with disabilities in Pakistan.

Let’s explore everything — from the latest profit rates and eligibility to investment limits, application steps, and FAQs — in this expert guide.

What Are Behbood Savings Certificates (BSCs)?

The Behbood Savings Certificates were launched by the Government of Pakistan through the Central Directorate of National Savings (CDNS) to support financially vulnerable groups such as:

- Senior citizens (aged 60 or above)

- Widows who haven’t remarried

- Persons with disabilities

- Parents or guardians of special children

The purpose is simple to offer a stable income stream and risk-free savings opportunity for those who deserve financial peace of mind.

Key Features at a Glance

| Feature | Details |

|---|---|

| Scheme Name | Behbood Savings Certificates (BSCs) |

| Managed By | Central Directorate of National Savings (CDNS) |

| Target Groups | Senior Citizens, Widows, Disabled Persons |

| Profit Type | Monthly Return |

| Profit Rate (Oct 2025) | 13.68% per annum |

| Minimum Investment | Rs. 5,000 |

| Maximum (Single Holder) | Rs. 7.5 Million |

| Maximum (Joint Holders) | Rs. 15 Million |

| Duration | Unlimited (withdraw anytime after 4 years without penalty) |

Latest Profit Rate — October 2025 Update

According to the latest CDNS notification (October 2025), the Behbood Savings Certificates profit rate is now 13.68% per annum — a slight increase from 13.20% earlier in mid-2025.

Example: If you invest Rs. 100,000, you’ll earn around Rs. 1,140 per month in profit — totally risk-free and backed by the government.

This consistent upward trend shows the government’s effort to support citizens amid inflation and provide better returns than most bank savings accounts or fixed deposits.

Why Choose Behbood Savings Certificates in 2025?

In today’s uncertain economy, investors prefer reliability over risk. The Behbood Savings Certificates combine security, high yield, and regular income — ideal for retirees and individuals seeking guaranteed profits.

Top Reasons to Invest

- Government-backed safety — your money is 100% secure under National Savings Pakistan.

- Attractive profit rate — 13.68% is among the highest in Pakistan’s savings products.

- Monthly income — perfect for pensioners or families relying on regular returns.

- Flexible withdrawal — encash anytime after 4 years with zero penalty.

- Joint account option — allows two eligible persons to co-invest.

- Tax benefits — reduced withholding tax for senior citizens and widows.

Real-Life Comparison

| Investment Type | Profit Rate (Approx.) | Risk Level | Payment Frequency |

|---|---|---|---|

| Behbood Savings Certificates | 13.68% | No Risk (Govt-backed) | Monthly |

| Bank Fixed Deposit | 8–9% | Low Risk | Quarterly |

| Prize Bonds | Variable (luck-based) | High Risk | Unpredictable |

| Mutual Funds | 10–14% (market-based) | Moderate | Variable |

Clearly, BSCs offer the best balance between profit and peace of mind.

Eligibility Criteria

The Behbood Savings Certificates are not open to everyone — only specific groups can benefit from this special scheme.

| Eligible Category | Required Proof |

|---|---|

| Senior Citizens (60+) | CNIC showing age |

| Widows | Husband’s death certificate + CNIC |

| Persons with Disabilities | NADRA Disability Certificate |

| Parents/Guardians of Disabled Minors | Proof of guardianship & child’s certificate |

Note: Joint investment is allowed between any two eligible persons, such as two senior citizens or a widow and a parent of a special child.

Investment & Withdrawal Rules

When you invest in Behbood Savings Certificates, you enjoy both flexibility and long-term security. Here are the important rules every investor should know:

Minimum & Maximum Investment

- Minimum: Rs. 5,000

- Maximum (Single): Rs. 7.5 Million

- Maximum (Joint): Rs. 15 Million

However, as per the October 2025 update, the government is expected to increase the total investment limit to Rs. 50 Lac (Rs. 5 Million) for new investors, especially for senior citizens — giving them greater opportunity to grow their income.

Encashment Rules

- Early withdrawal before 4 years = small service charge.

- After 4 years = full amount withdrawable without penalty.

- Profits can be directly credited to your bank account or collected via crossed cheque.

Profit Payment Schedule

| Month | Payment Date |

|---|---|

| January | 1st working day |

| February | 1st working day |

| March | 1st working day |

| … | (Continues monthly) |

This ensures a steady monthly cash flow, ideal for household budgeting.

How to Apply for Behbood Savings Certificates (Step-by-Step)

Applying for Behbood Savings Certificates is simple and quick — no online registration is required yet, but CDNS is working on introducing digital onboarding by early 2026.

Offline Application Process

- Visit your nearest National Savings Center (NSC).

- Ask for the SC-1 form (Behbood Savings Certificate Application).

- Fill out the form carefully and attach the following:

- CNIC (original & copy)

- Two passport-size photographs

- Proof of eligibility (pension book, widowhood certificate, or disability certificate)

- Bank account details for profit transfer

- Deposit your investment amount through cash, cheque, or pay order.

- Once verified, your certificate will be issued the same day.

Tip: Always keep your original receipts safe for future encashment or profit withdrawals.

Online Investment Options (Upcoming in 2026)

The CDNS has announced plans to digitize all National Savings Schemes, including Behbood Savings Certificates. Soon, investors will be able to:

- Apply and invest online through savings.gov.pk

- Track profits and maturity dates via a mobile app

- Transfer profits directly into linked bank accounts

This initiative will modernize the National Savings system and make BSCs more accessible for overseas Pakistanis too.

Documents Required for Application

| Document | Purpose |

|---|---|

| CNIC (Original + Copy) | Identity verification |

| 2 Passport Photos | Record keeping |

| Eligibility Proof | Disability, widow, or senior proof |

| Bank Account Details | Monthly profit transfer |

| Investment Proof | Deposit slip or cheque |

Tax Rules & Deductions

Even though Behbood Savings Certificates are tax-friendly, a small withholding tax applies on monthly profit:

| Category | Tax Rate |

|---|---|

| Filer | 10% |

| Non-Filer | 20% |

However, widows, senior citizens, and persons with disabilities enjoy reduced or exempted tax rates as per FBR’s updated circular (2025).

Tips to Maximize Your Returns

To make the most of your Behbood Savings Certificates in 2025, follow these simple but powerful strategies:

- Reinvest profits into other CDNS schemes like Defense Savings Certificates.

- Stay updated on profit rate changes every quarter on the CDNS official website.

- Avoid early encashment — let your investment run beyond 4 years.

- Keep your CNIC and proof documents valid to prevent profit delays.

- Consider joint accounts to double your investment cap legally.

Behbood Savings Certificates vs Other National Savings Schemes

| Scheme Name | Profit Rate (Oct 2025) | Eligibility | Payment Mode | Risk |

|---|---|---|---|---|

| Behbood Savings Certificates | 13.68% | Special groups | Monthly | None |

| Regular Income Certificates | 12.84% | General public | Monthly | None |

| Defense Savings Certificates | 13.20% | General public | Maturity-based | None |

| Pensioners’ Benefit Account | 13.68% | Pensioners only | Monthly | None |

FAQs

1. What is the latest Behbood Savings Certificates profit rate in October 2025?

The current profit rate is 13.68% per annum, as per the latest CDNS notification in October 2025.

2. Who can invest in Behbood Savings Certificates?

Senior citizens (60+), widows, disabled persons, and guardians of special minors are eligible to invest.

3. What is the minimum and maximum investment limit?

You can invest a minimum of Rs. 5,000 and up to Rs. 7.5 million (single) or Rs. 15 million (joint). The limit is expected to increase to Rs. 50 Lac soon.

4. How can I apply for Behbood Savings Certificates?

Visit any National Savings Center, fill out the SC-1 form, attach required documents, and deposit your investment amount.

5. Are Behbood Savings Certificates taxable?

Yes, a small withholding tax applies 10% for filers and 20% for non-filers, but senior citizens and widows get special relief.

Conclusion

The Behbood Savings Certificates (October 2025 update) continue to be the most profitable and secure investment option in Pakistan, especially for senior citizens, widows, and disabled individuals.